Carmel Boyer School of Business

AT BW, YOU LEARN BY DOING

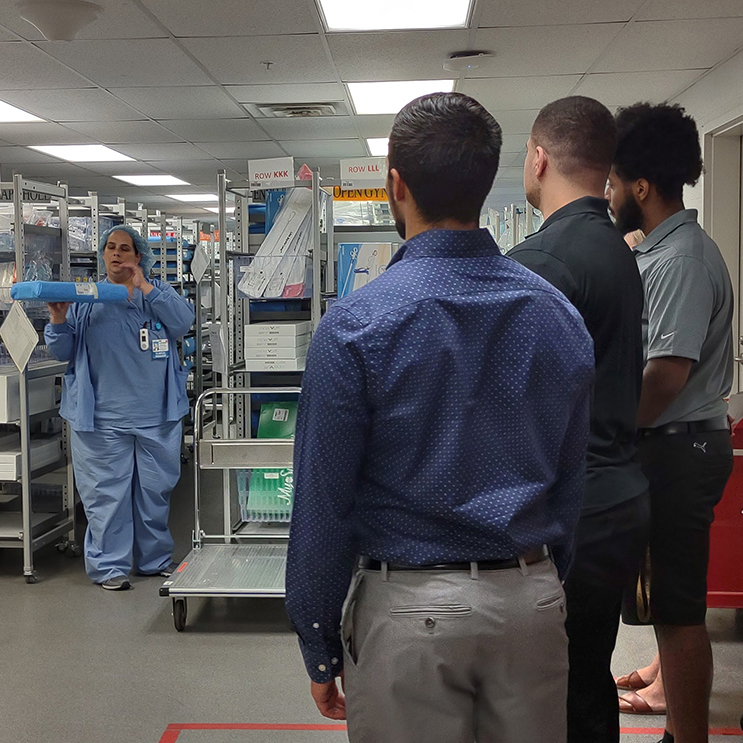

Real-world success begins with real-world learning. Advance your knowledge and skills, help organizations develop, build connections, and learn from dynamic professionals who will mentor you along the way.

Personable and approachable, our professors are well-connected corporate executives, innovative thought leaders, industry consultants, and published scholars who focus on hands-on, experience-based learning — going beyond books and lectures to prepare tomorrow’s professionals and strengthen today’s managers to be successful and strategic leaders.

POWERFUL & PROVEN BUSINESS DEGREE

At every Fortune 500 company with a presence in Northeast Ohio, there is a BW grad leading teams and managing growth. Our strong network is a testament to the value of a Baldwin Wallace business education and how BW integrity, purpose and drive are inspiring leaders who excel in innovation, forge lasting community and industry impact, and achieve deep personal fulfillment.

Accreditation

The Baldwin Wallace University Carmel Boyer School of Business is accredited by the Accreditation Council for Business Schools (ACBSP). To ensure we're providing the best experience to our students, we regularly evaluate student enrollment, retention, and program completion. Learn more about ACBSP accreditation.

Experience Business at BW

Undergraduate Programs In Business

Learn today, lead tomorrow. Pursuing your bachelor’s degree at Baldwin Wallace University Carmel Boyer School of Business will connect you to opportunities in and out of the classroom that will shape your successful career. Faculty, not teaching assistants, lead dynamic courses designed to help you stand out in the job market. BW offers more than just bachelor’s degrees. From innovative projects to industry certifications to networking events and mentoring, our programs position you not only for great first jobs after graduating, but also for promotions and advancement in the years to come.

Graduate Programs In Business

Whether you are gearing up for a promotion at work, looking to make a career pivot, or need additional education for licensure, graduate business programs at BW will enable you to enhance your skills, expand your network, and advance your career. BW offers more than just bachelor’s degrees. From innovative projects to industry certifications to networking events and mentoring, our programs position you not only for great first jobs after graduating, but also for promotions and advancement in the years to come.

Professional Development & Executive Education

BW offers non-credit professional development and training that provides practical, hands-on, applicable scaling and upskilling. We’re intentional, creative and flexible with who we engage to teach custom courses, leveraging faculty from across BW's campus in various disciplines.

Industry & Community Engagement

Our approach to business education is simple: Learn by doing. This involves connecting students to opportunities, employers to talent, and the campus to the community.